7th July 2023

Sanctuary

Sanctuary is pleased to report a strong performance for the financial year 2022/2023. The last 12 months have seen another period of growth and recovery from the pandemic. The Group’s financial results reflect this progress with an improvement in surplus before tax which has been invested back in record reinvestment spend of £96m, while maintaining appropriate levels of financial robustness and resilience.

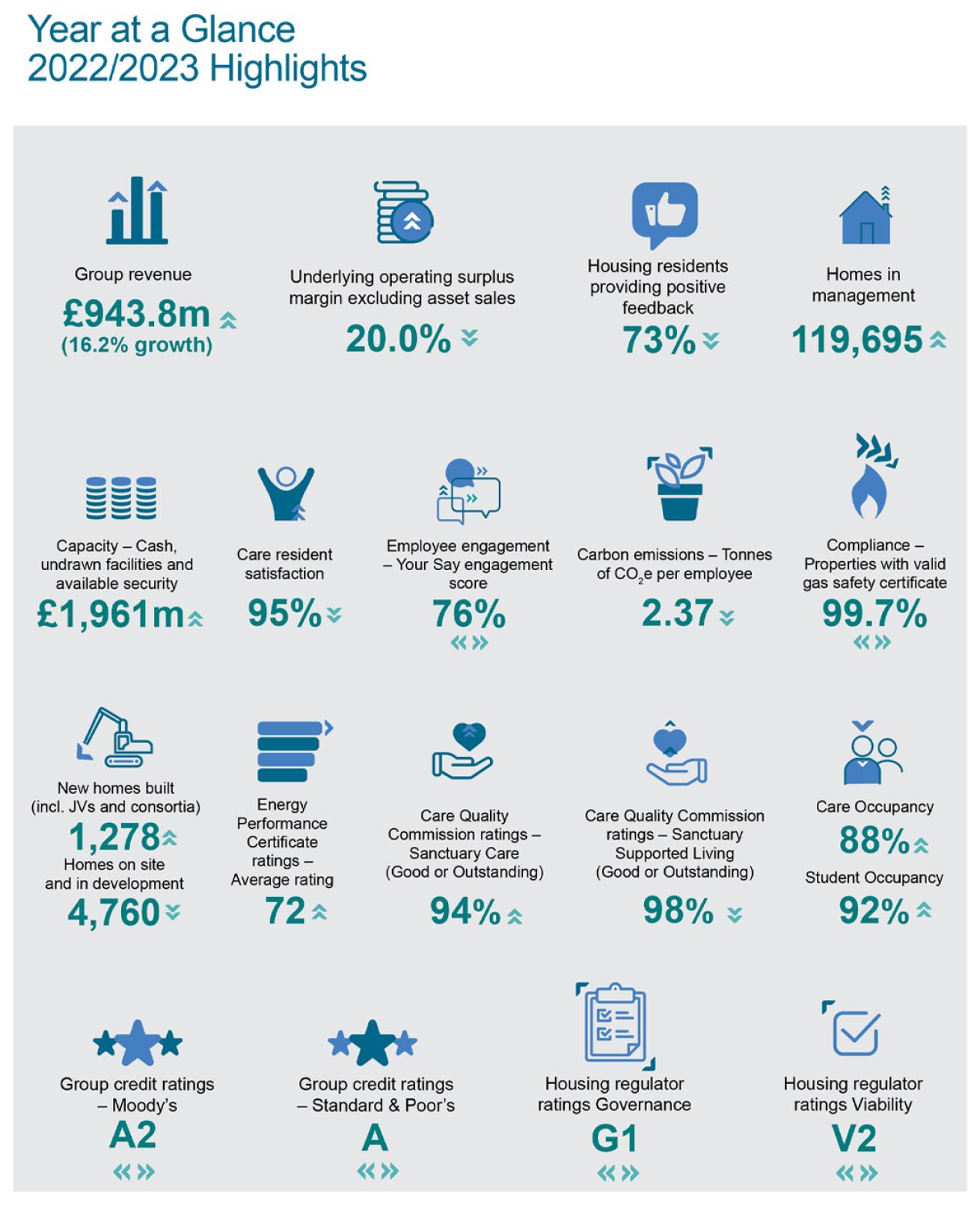

Key financial highlights:

- Homes in management up 13.4% to 119,695

- Revenue up 16.2% to £943.8m

- Operating surplus up 11.8% to £199.6m

- Operating margin of 21.1% (2022: 22.0%)

- Underlying operating margin of 20.0% (2022: 21.2%)

- Social housing operating surplus margin of 33.1% (2022: 35.7%)

- Surplus before tax up 72.9% to £101.3m

- Underlying surplus before tax up 23.1% to £58.1m

- EBITDA up 9.0% to £279.8m

- EBITDA MRI interest cover of 120.3% (2022: 128.4%)

- Cash and undrawn facilities of £614.1m (2022: £535.1m)

Revenue growth across all business areas, combined with £51.9m of additional revenue from in-year business combinations, has resulted in total Group revenue of £943.8m, an increase of £131.3m (16.2%) from the prior year.

The Group’s affordable housing business benefited from an increase in revenue from existing homes, which, together with additional revenue from 869 new affordable homes, resulted in growth of £17.0m (4.2%).

Revenue growth within the care business of £33.5m (17.4%) was driven by improved occupancy as the business accelerated its recovery from the pandemic, combined with income from 13 additional care homes added through the acquisition of Cornwall Care in October 2022.

The Group’s student business also saw further recovery from the pandemic, with occupancy increasing two percentage points to 92%, achieving revenue growth of £3.2m (5.6%).

Revenue from the sale of 307 developed properties saw an increase of £36.7m (66.2%) over the prior year as a result of increased sales volumes. The Group continues to have a modest development programme with only 13% of revenue being derived from shared ownership and outright sales.

The Group operating surplus of £199.6m is £21.0m (11.8%) higher than the prior year (2022: £178.6m). The underlying operating surplus of £188.7m, adjusted to remove fixed asset sales surpluses, represents a £16.5m (9.6%) increase from the prior year (2022: £172.2m), reflecting continued growth, recovery from the pandemic and efficiencies across businesses.

The operating margin is 21.1% compared to 22.0% in the prior year. The underlying operating margin is 20.0% compared to 21.2% in 2022 reflecting increased investment in properties, development sales and the impact of steeply rising cost inflation compared to modest rental income increases of only 4.1% and 3.0% in England and Scotland respectively.

The Group has weathered some of the inflationary pressures in 2023 through fixed price contracts, an energy hedging strategy and part-year pay awards.

Surplus before tax of £101.3m is £42.7m (72.9%) higher than the prior year (2022: £58.6m). This reflects a £38.5m net gain on acquisitions, predominantly relating to Swan. Underlying surplus for the year is £58.1m, which is £10.9m (23.1%) higher than the prior year (2022: £47.2m), reflecting the benefit of growth and recovery from the pandemic, partially offset by higher interest costs.

The business combination with Swan Housing Association on8 February 2023 has had a negligible impact on the financial performance and position in the financial year 2022/2023.

Strong operational metrics continue to underpin our financial performance. Rent arrears remained stable and low at 3.25% (2022: 3.21%) and void losses improved to 1.8% (2022: 1.9%).

EBITDA MRI interest cover remained high at 120.3% (2022: 128.4%) which reflects that, through growth, the Group has been able to enhance reinvestment spend, while maintaining solid cash interest cover performance.

The continued strength of Sanctuary’s liquidity is highlighted by the closing cash balance for the year of £180.1m (2022: £102.1m) and undrawn facilities of £434.0m (2022: £433.0m), which, coupled with new facilities secured after the year end, provides the Group with 29 months of financing versus committed expenditure.

Ed Lunt, Sanctuary’s Chief Financial Officer, said: “Our results place us in a good position to pursue our strategic objectives, deliver to our customers and fulfil our social purpose, while having the continued financial capacity to withstand external economic factors, including inflationary pressures.”

Year at a Glance - 2022/23 Highlights